Explain Cost of Capital With Different Sources of Finance

Internal source of finance. 21 Costs of the sources of.

Cost Of Capital Define Types Debt Equity Wacc Uses Factors Efm

Why different sources of capital have different costs.

. A firm raises funds from various sources which are called the components of capital. Sources of finance employed by the firm such as. Debt financing is more tax-efficient than equity financing since interest expenses are.

The overall cost of capital depends on the cost of each source and the proportion of each source used by the firm. The cost of each source. Financial backing usually includes loans grants or investor funding.

If a company only obtains financing through one sourcesay common stockcalculating its cost of capital would be relatively simple. The formula for calculating the cost of debt is as follows. The factors that need to be considered when choosing an appropriate source of finance are.

Interest is a little higher than forbank loans and interest is calculated on a daily. How to Calculate Cost of Capital. Based on mode of finance.

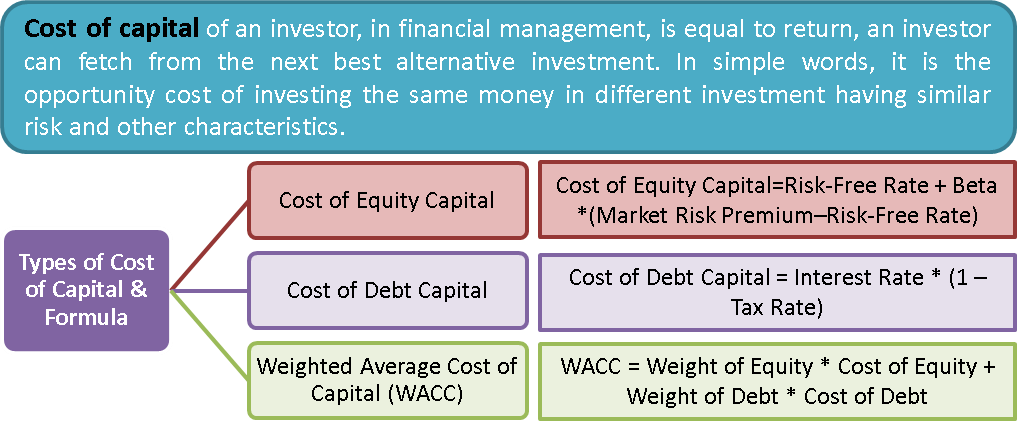

Taxes can have a significant impact on the weighted average cost of capital WACC of a company. Cost of Debt Capital Interest Rate 1 Tax Rate Weighted Average Cost of Capital WACC. However this method of raising funds for working capital is a time-consuming process.

The main sources of funding are retained earnings debt capital and equity capital. Personal Sources- Investing the capital from hisher own pocket or from there savings Profits- The surplus remaining after total costs are deducted from total revenue are invested in the business. In fact the cost is more in the nature of an opportunity cost foregone rather than an actual cost outflow.

External source of finance. WACC provides us a formula to calculate the. Companies use retained earnings from business operations to expand or distribute dividends to their shareholders.

It is also called a Weighted Average Cost of Capital WACC. 3 Short Term Sources of Finance. The amount of money needed The urgency of funds The cost of the source of finance The risk involved The duration of finance The gearing ratio of the business The control of the business P2.

Analyse the costs of different sources of finance Working capital. Sources of finance for business are equity debt debentures retained earnings term loans working capital loans letter of credit euro issue venture funding etc. When a firm raises funds from different sources it involves a series of cash flows.

For example the cost of raising funds through issuing equity shares is different from that of raising funds through issuing preference shares. The major ones include equity shares issuing debentures as well as acquiring secured loans from financial institutions. There are other methods for financing such as credit cards or invoice financing but these should be used only if you need cash quickly and know the risks involved.

The cost of external sources of finance has to be paid to outside entities and is thus much higher. Long term loans will earn a higher interest rate than. Bank finance is made available to small- scale enterprises at concessional rate of interest.

There is another category where the above sources of funds are categorised into three types as mentioned below. - Size of loan usually large borrowers will be charged higher interest rates than. Angel Capital- Angel Investor An investor who provides financial backing for small startups or entrepreneurs.

The source includes borrowings from a public deposit commercial banks commercial paper loans from a financial institute and lease financing etc. The cost of debt capital is the cost of using a banks or financial institutions money in the business. Ko Overall cost of capital Wd Weight of debt Wp Weight of preference share of capital.

The explicit cost of any sources of capital may be defined as the discount rate that equates the present value of the cash inflows that are incremental to the taking of the financing opportunity with the present value of its incremental cash outflow. Below is a list of some of the best sources of long term financing for a business. As it is evident from the name itself cost of capital refers to the weighted average cost of various capital components ie.

It is also referred to as weighted average cost of capital. The most common approach to calculating the cost of capital is to use the Weighted Average Cost of Capital WACC. Businesses raise funds by borrowing debt privately from a bank or by going public issuing debt securities.

The formula to arrive is given below. Equity shares is the main source of long term finance for most business. Companies strive to attain the optimal financing mix based on the cost of capital for various funding sources.

These sources of funds are used in different situations. Such loans are known as clean advances. Short Term Source of Finance These are funds just required for a year.

- Duration of lending eg. An ownership source of finance. If investors expected a rate of return of 10 in order to.

The banks get their compensation in the form of interest on their capital. Source of finance some factors have to be considered. The Effect of Taxes on Debt In many tax jurisdictions interest on debt financing is a deduction made before arriving at the taxable income of a company.

Some of the top ways to raise capital are through angel investors venture capitalists government grants and small business loans. Different sources of fund or the components of capital have different costs. Different sources have different costs because of.

Cost of capital is a composite cost of the individual sources of funds including equity shares preference shares debt and retained earnings. Following are steps involved in the calculation of WACC. Based on sources of generation.

Are a few examples of these sources. Cost of finance The cost of internal sources of finance is much lower than external sources of finance. Short term loans due to the maturity risk premium.

Working Capital Loans from Commercial bank and trade credit etc. Composite capital is the combined cost of different sources of capital taken together. They do not have any costs as it owner money that will be invested to start a business.

Hence it is generally a cheaper source of financing working capital requirements of enterprise. Under this method all sources of financing are included in the calculation and each source is given a weight relative to its proportion in the companys capital structure. However taxes affect the cost of capital from different sources of capital in different ways.

Evaluating New Projects With Weighted Average Cost Of Capital Wacc Cost Of Capital Weighted Average Accounting And Finance

Financial Structure Capital Structure Capitalization And Leverage Business Risk Financial Cost Of Capital

Comments

Post a Comment